Bed Bath & Beyond: The Fall of a Leadership Brand

05.16.2023

Bed Bath & Beyond has recently announced that they are leaving the US market, yet another example of how important meaningful differentiation is and how fast you can lose it.

The pandemic shook the status quo and brought many changes and challenges for brands. Today consumers have different priorities, have higher expectations, are more critical, and are exposed to more options. This leads to a higher importance on uniquely meeting peoples’ needs.

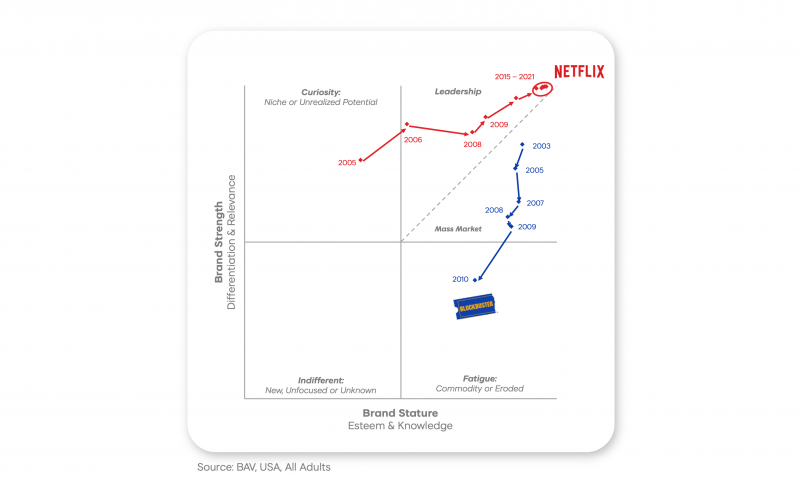

Brand Asset® Valuator (BAV) has studied more than 60,000 brands and their relationship with consumers in 52 markets since 1993. In our model, we find that differentiation and relevance are leading indicators that capture future growth value; we call this Brand Strength. Through the BAV lens, we have seen several brands losing momentum due to a lack of differentiation and an inability to connect with people’s expectations and desires. When this happens, there is room for other direct or indirect competitors to take advantage of the situation. An excellent example of this is Blockbuster, losing energy since 2003 and leaving room for brands like Netflix and other on-demand platforms. These brands were able to meet the same need and desire for entertaining but in a faster, frictionless, and personalized way. They were meeting people’s desires in unique and even disruptive ways.

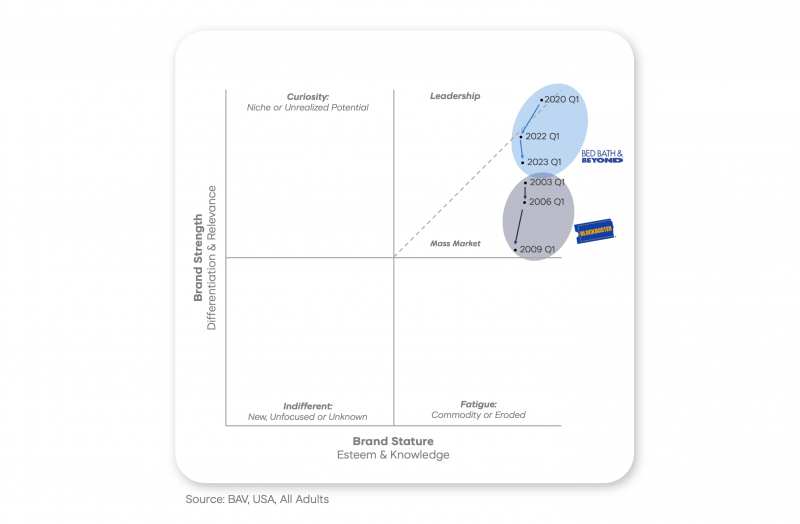

Like Blockbuster, Bed Bath & Beyond struggled to maintain its position as a meaningful, unique, and desirable brand in people’s life. The Brand Strength that Blockbuster lost in 6 years, Bed Bath & Beyond lost it in 3, which reflects a more accelerated market pace Losing Brand Strength reflects weakening emotional connections, which leads to less consideration and usage of a brand. There is a strong correlation between Brand Strength, as BAV defines it, and a company’s financial performance. Since the pandemic started, we can see how Brand Strength began to fall, indicating what would happen years later. The brand lost 20% of its differentiation from Q1 2020 to Q1 2023, which is a leading indicator that the brand is struggling. The 2022 annual revenue reported was $6.21 B, 45% less than the reported for 2019.

The departure of Bed Bath & Beyond from the market is a reminder that the retail landscape is a crowded, commoditized, and constantly evolving category. The more brands there are in a category, the more critical it is to stand out. Brands need to adapt, change, and stand out to survive. Differentiation is what keeps a brand growing, so being authentic, dynamic, and original is not a cosmetic thing in the retail category.

QUESTIONS TO ASK

- How much time, effort, and resources are we investing in being the most innovative brand in the category?

- What is the one thing we are doing differently from our competitors?

- What is the one reason we give our customers to choose us instead of another brand?

Especially during tough and uncertain times, brands focus on being relevant, returning to basics, and what they think people want. Brands often forget the importance of daring to do something distinct.

Natalia Restrepo, Associate Director Insights and Strategy

Natalia Restrepo is an Associate Director who has worked with BAV since 2013 across LATAM region and currently from the United States. She had the opportunity to work with both local and regional clients using data to answer business questions and solving marketing challenges. Natalia is truly passionate for understanding people’s behaviors and how they interact with brands.

Originally from Colombia, Natalia graduated from advertising and branding, which led her to build a career on brand strategy, comms, market research and consultancy with a focus in FMCG categories and Retail.